Summary: The domestic market price of VE

continued to drop in 2015, because of the fierce industrial competition. It is

estimated that the price of V E will be kept at a low level or even to drop in

the short run while the price will be on the increase in the long run.

Starting from 2015, the price of vitamin E

(VE) continued to drop because of the overcapacity, the increasing supply and

weak demand from downstream industries. Based on the current market conditions,

the major domestic VE manufacturers will adapt different marketing strategies

which may influence the price of VE. It is estimated that the price of VE will

continue to drop in the short run while its price will increase in the long

run.

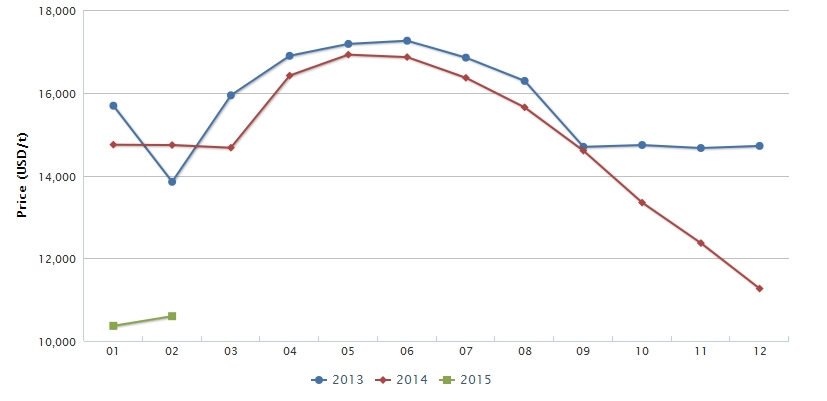

Market price of 50% powder feed grade VE in China, 2013-Feb. 2015

Source: CCM

Since 2015, the price of VE keeps dropping.

According to CCM's investigation, the market price of VE (50% powder feed

grade) was USD11,599/t in Feb. 2015, down by 30% compared with the figure

USD16,862/t in June 2014. The following three reasons could illustrate the

price drop.

1. Chinese VE manufacturers

launched price war. Starting from June 2014, Zhejiang Medicine Co., Ltd.

(Zhejiang Medicine) and Zhejiang NHU Co.,Ltd. (NHU) (the two biggest VE

manufacturers in China ) started a price war to fight with competitors and

improve their own market shares.

Even though the global VE industry has

overcapacity, more and more new entrants are attracted to enter this industry

for the high profit. They triggered price war. At present, the major VE

manufacturers in China are Zhejiang Medicine, NHU and PKU International

Healthcare Group (PKU). In the international market, the major VE manufacturers

are BASF and DSM. In fact, the capacity of the mentioned five manufacturers

could satisfy the demand from the world.

In 2014, the capacity of VE in the world

was 84,000 t/a while the demand for it was only 63,000 tonnes, indicating that

the overall capacity was 30% larger than its demand. Furthermore, Jilin Beisha

Pharmaceutical Co.,Ltd. (Jilin Beisha) built a new 9,000 t/a VE production

line, making the company's overall capacity of VE reaching 10,000 t/a. But, the

actual capacity of this production line was only 5,000 t/a-6,000 t/a because of

the high cost. This also could reduce the company's deficit.

2. The cost of VE dropped because

of the increasing raw material supply. Nenter & Co., Inc (Nenter) expanded

the capacity of 2,3,5-trimethyl hydroquinone (an important intermediate of VE)

to 80,000 t/a by the new technology. According to CCM's investigation, the

major VE manufacturers, Zhejiang Medicine, Zhejiang NUH and Jilin Beisha had

signed supply contract with Nenter.

3. The demand from downstream

industries was weak. The downstream livestock industry was in downturn, thus

their demand for VE was weak (feed industry consumes 80% of VE in China). Take

live pig farming as an example, data from the Ministry of Agriculture of the

People's Republic of China showed that the inventory of live pig in February

decreased by 3.9% month on month, down by 10.1% year on year; while, the

inventory of sow decreased by 1.9% month on month, 15.5% year on year. This was

lower than the warning figure 5% for 12 consecutive years. The demand for VE

from the sluggish live pig industry was weak. It is known that the annual

growth rate for the demand of VE (50% powder feed grade) was only between

2.0%-2.5%. The growth rate from demand lags behind the growth rate from supply

heavily.

It is noted that the operating profit for

the major three VE manufacturers dropped because of VE price drop. For example,

according to the annual performance report of NHU, the company's revenue and

net profit in 2014 was USD4.16 million (RMB25.52 million) and USD131.48 million

(RMB808.26 million), down by 1.7% and 8.4% year on year. Besides, Zhejiang

Medicine estimated that its net profit for the whole year of 2014 would

decrease by 55%-75% year on year and the figure in 2013 was USD73.54 million

(RMB452.10 million).

In 2015, the major VE manufacturers may employ different marketing

strategies. It is known that Zhejiang Medicine would continue to cut

down its sales price to compete with other competitors.

However, NHU and PKU may reduce

their production to ease the overcapacity of VE in the

global market, and to make the price rebound.

Their different marketing strategies would influence the price of VE. In

the short run, the price of VE may continue to drop. However, in the

long run, VE manufacturer's marketing strategies would push

up the price of VE.

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about

CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.